The bigger picture behind Wrexham’s newly listed share allotment

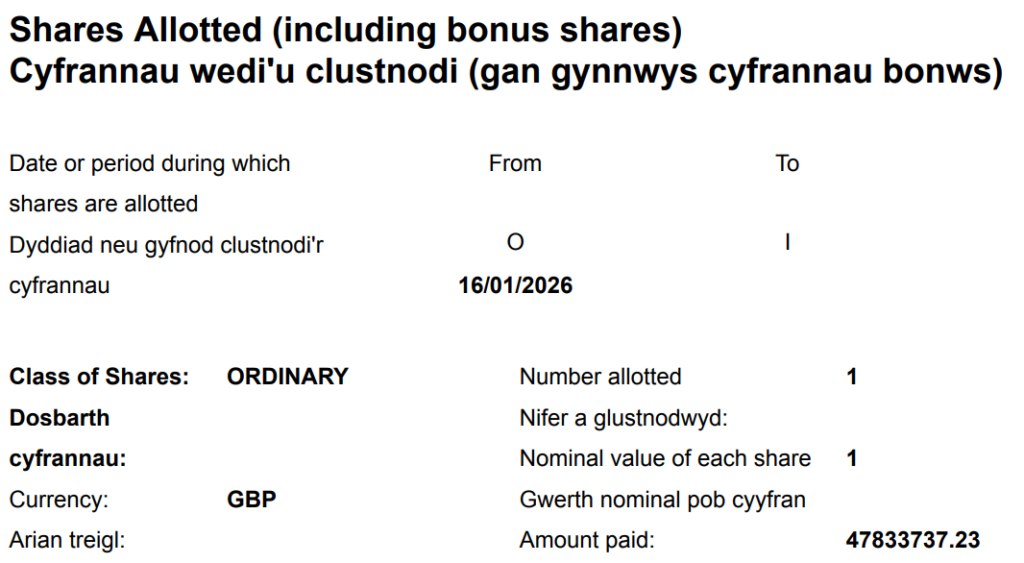

The newly listed Companies House filing confirming a major share allotment at Wrexham AFC has quickly shifted the conversation from discovery to implication.

As outlined in our original report, the document provides hard confirmation of a completed capital move rather than a future promise. That distinction matters, because it changes how the club’s current position can be understood.

For context, the filing itself was first detailed in this earlier report, which set out the technical facts now visible on the public register.

Read more about Wrexham’s Companies House Filing here.

What this kind of capital injection actually represents

A share allotment of this nature is not the same as prize money, transfer income, or operating revenue. It is a balance sheet event, designed to alter the club’s underlying financial position rather than its week-to-week cash flow.

In practical terms, it strengthens the club’s capital base. That matters because football clubs do not operate in isolation from accounting reality, even when ambition is high.

A healthier capital position improves flexibility. It can support investment, absorb risk, and provide a buffer against volatility, particularly in periods where spending decisions carry long-term consequences.

What stands out here is not simply the scale of the transaction, but its structure. A fully settled share issue with full rights attached points to long-term intent rather than a short-term fix.

This is not money raised to plug a hole. It is capital placed into the club in a way that reshapes its foundation.

Why this matters for Wrexham’s next phase

Wrexham’s rise over recent seasons has already changed expectations around the club. With that comes a different level of scrutiny, particularly around sustainability.

Ambition in football often runs ahead of infrastructure. Clubs can chase growth before their financial framework is ready to support it. This filing suggests a conscious effort to align the two.

From an ownership perspective, formalising capital in this way creates clarity. It reduces reliance on short-term solutions and places more of the club’s future on a defined footing.

That does not automatically translate into immediate action on the pitch. It does, however, expand the range of what is possible without placing strain on the club’s stability.

There is also a signalling effect. Official filings are not gestures. They are deliberate, documented decisions that remain part of the public record.

For supporters, the significance lies less in any single outcome and more in what it says about direction. This is a move that prioritises structure, resilience, and readiness for the next stage of growth.

In that sense, the Companies House return is not just a financial footnote. It is a snapshot of where Wrexham see themselves now, and where they are preparing to go.